Irs Schedule C Form 2022

If you're looking for irs schedule c form 2022 images information connected with to the irs schedule c form 2022 topic, you have visit the ideal site. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

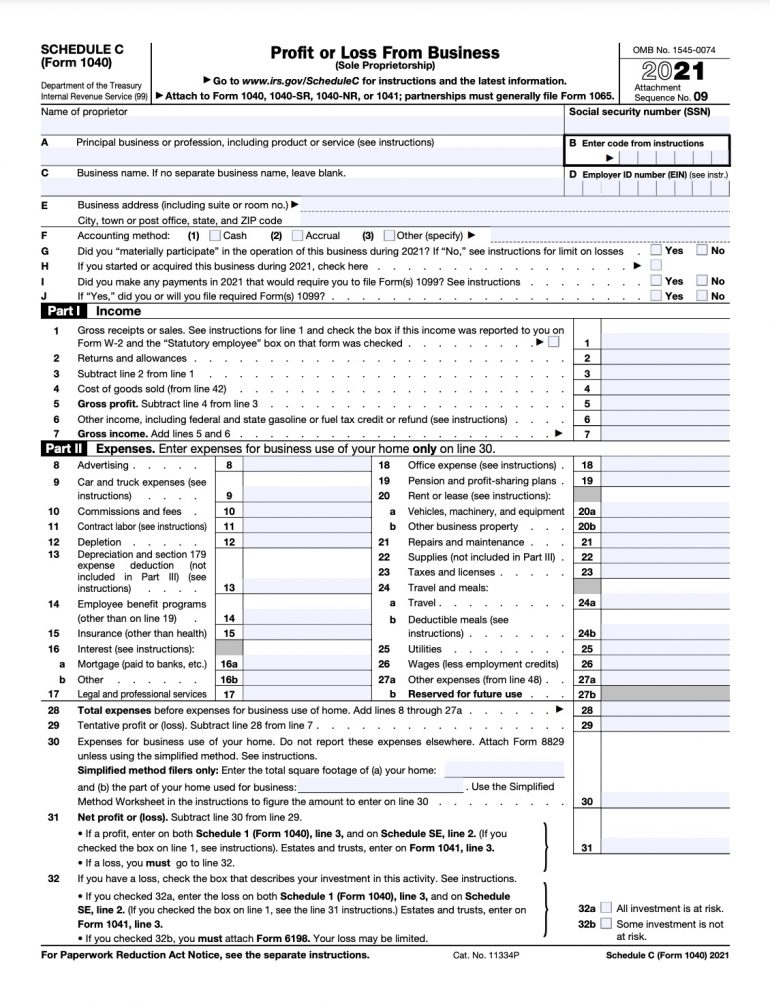

Irs Schedule C Form 2022. The income on schedule c is typically reported on form 1040 line 12 as business income. If you have deductible expenses, itemizing may be a more favorable.

Before going to the question of quality, it is important to be aware of the management of the revenue utilized over a set period. 4500)the medium to submit the application fee of iift 2022 is as. Numerous vendors on the internet offer you to work with documents online.

Married filing separately mfs head of.

An activity qualifies as a business if: Irs form 1040 schedule c | profit and loss from business. An activity qualifies as a business if: Turn them into templates for numerous use, add fillable fields to collect recipients?

If you find this site {adventageous|beneficial|helpful|good|convienient|serviceableness|value}, please support us by sharing this posts to your {favorite|preference|own} social media accounts like Facebook, Instagram and so on or you can also {bookmark|save} this blog page with the title irs schedule c form 2022 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.