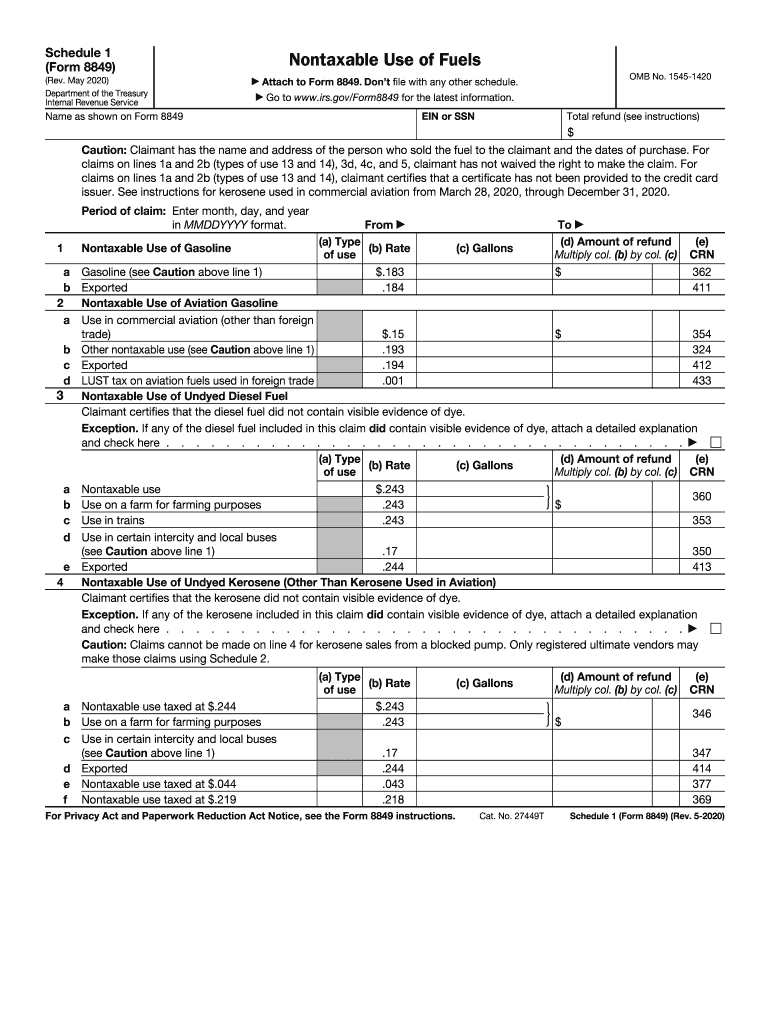

Irs Schedule 1 Instructions 2022

If you're looking for irs schedule 1 instructions 2022 images information related to the irs schedule 1 instructions 2022 interest, you have visit the ideal blog. Our site frequently gives you hints for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Irs Schedule 1 Instructions 2022. If you’re received advanced child tax credit payments at any time during 2021, fill out schedule 8812 and attach it to your return. Enter the amount from schedule i (form 1041), line 79 on line 4 of the worksheet.

March 2022) allocation schedule for aggregate form 941 filers department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. To www.irs.gov/form1040 for instructions and the latest information. Estimated income tax voucher instructions:

53 tax credits and deductions you can claim in 2022.

You must report the monthly payments received during 2021 so that you can figure. Wisconsin schedule u is used to compute the interest due. Under the monthly deposit schedule, deposit accumulated taxes on payments made during a calendar. Employer's annual railroad retirement tax return 2021 01/25/2022 form 461:

If you find this site {adventageous|beneficial|helpful|good|convienient|serviceableness|value}, please support us by sharing this posts to your {favorite|preference|own} social media accounts like Facebook, Instagram and so on or you can also {bookmark|save} this blog page with the title irs schedule 1 instructions 2022 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.